Volatility in the Mexican offshoring industry

Résumé

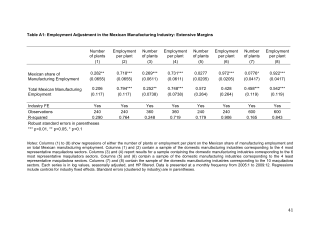

This paper studies how volatility in the Mexican maquiladora employment and wages are allocated between the number of plants operating each month (extensive margin) and the average employment per plant (intensive margin) among different groups of sectors, through a decomposition exercise. Then, the paper analyzes the impact of foreign affiliates located in Mexican regions on business cycle comovements based on the theory of the granular origins of aggregate fluctuations. For the first objective, the main contribution of this paper is to extend the work done by Bergin, Feenstra, and Hanson (2009) in two directions: sector coverage and timeperiod. We find that for the most representative maquila sectors (apparel, chemicals, electronics, electrical equipment, furniture, and transportation equipment), adjustments in the number of plants are larger than for the least representative sectors (food processing, footwear, machinery, and toys), in particular during a period comprising a crisis. Thus, the least representative sectors are less volatile and less dependent on global production sharing. Moreover, the current paper also presents a decomposition exercise for wages in the maquiladora industry, which was not previously analyzed. The purpose of this additional exercise is to show how volatility in wages is allocated between the number of plants (extensive margin) and the mean wages (intensive margin) for different groups of sectors. We find empirical evidence suggesting that for the most representative maquila sectors, adjustments in the number of plants are larger than for the least representative sectors. Once again, the least representative sectors are less volatile and less dependent on global production sharing. For the second objective, the idea is to show how shocks experienced by a few large multinational enterprises have the potential to generate fluctuations on Mexican states' GDP. The analysis focuses on the largest 100 multinational enterprises engaged in offshoring activities with affiliates established in Mexican regions. We find empirical evidence supporting the claim that the presence of foreign affiliates in Mexican regions significantly increases the correlation between the fluctuations of the regions' GDP and the GDP of the source country.

Domaines

Economies et finances

Fichier principal

2013-_GOMEZ_Vol_Annexe.pdf (82.35 Ko)

Télécharger le fichier

2013-_GOMEZ_Vol_Memoire.pdf (1.69 Mo)

Télécharger le fichier

2013-_GOMEZ_Vol_Annexe.pdf (82.35 Ko)

Télécharger le fichier

2013-_GOMEZ_Vol_Memoire.pdf (1.69 Mo)

Télécharger le fichier